ARS

Account Reporting System (ARS)

Say goodbye to the time-consuming management of bank portals and say hello to increased efficiency and visibility. With ARS, bank account information and transaction data from all bank counterparts are captured, formatted, validated, and delivered via client’s choice of a single repository for multi-bank analysis.

Challenges in bank account management

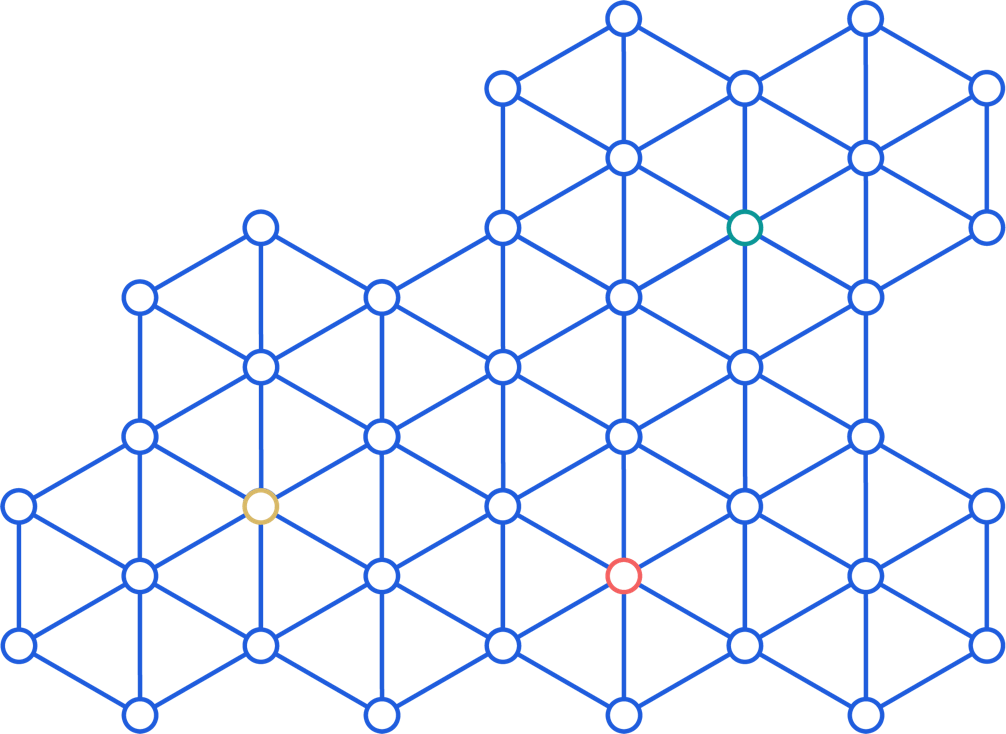

Global bank

relationsBank partners are spread all over the world. There is a variety of bank portals and account file formats.

Lack of

automationBank connectivity and data aggregation are continuous challenges. High volume data is often collected manually from each individual bank portal.

Tight

budgetsThere is typically no money or resources for system integration, dedicated BIC codes or staff training on bank communication.

Disparate transaction

data platformsGlobal companies using multiple versions of their ERP or TMS are often unable to economically and accurately consolidate and reconcile transactions.

What our Clients Say

Year over year, I receive value from Fides. They give me confidence in my bank connections and allow me a tremendous amount of flexibility. My bank relationships change over time and it would be impossible to maintain individual connectivity and redo all those interfaces. By outsourcing the interfaces to Fides I could essentially change banks every week if I needed to because Fides takes care of it all.

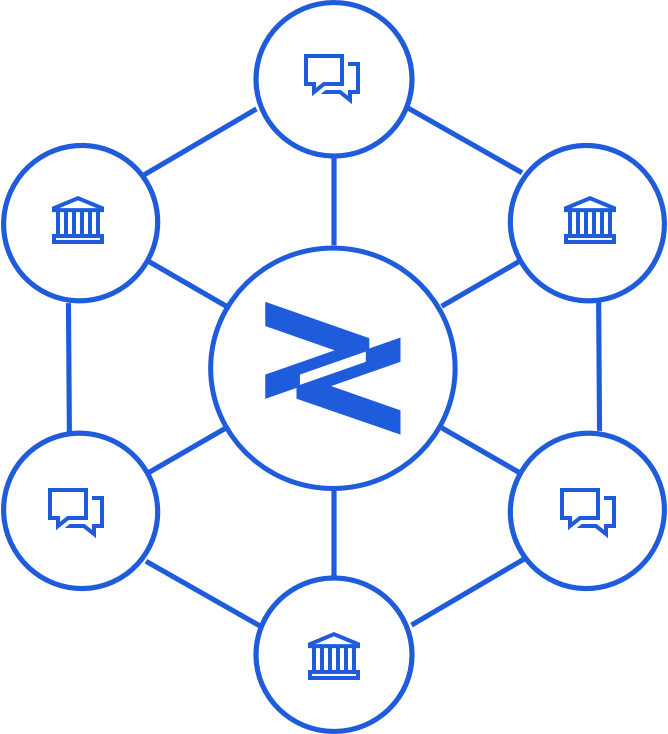

ARS – Single Platform for Multi-Bank Aggregation

- Centralized Access

- Bank Connectivity Service

- Validation Service

- System Integration

Global transaction transparency

Using a single source for all bank communications makes it easy for multinational companies to gain visibility into global cash positions.

Reduced operational risk

As transaction data is loaded automatically, finance professionals do not need to enter data manually. Errors are avoided and time is saved.

Independent provider

As Fides is an independent provider for multi-bank services. The client’s transaction data and share of wallet is only visible to the client.

Truly global reach

Fides hybrid approach allows to connect via SWIFT, EBICS or any other network globally to any bank. Even the smallest bank in the most remote part of the world can be accessed using ARS’ connectivity capabilities.

Carefree bank integration set-up

Fides is organizing everything that’s necessary to set up bank communications. As part of our all-inclusive service, the Fides Bank Connectivity team handles all of the manual bank set-up on the client’s behalf.

Accurate transaction data

Fides has implemented tight controls to assure statement formats and content are accurate.

Smooth account reconciliation

Thorough data validation capabilities and services ensure that opening and closing bank balances, statement formats and any other transaction data points are correct and consistent for bank account reconciliation.

Consistent reporting

Reliable data is the basis for consistent reporting across all banks. Regardless of how clients access the platform – ERP integration, TMS integration, direct access via the Fides ARS Web Portal, clients can access real-time insights at the click of a button.

Straight-through processing

The ARS solution can be accessed by an infinite number of delivery methods:

- TMS and ERP Integration

- All Fides solutions can be integrated with any treasury management system (TMS) and ERP system, even if the client uses multiple versions.

- Web Portal Access

- For organizations that do not subscribe to a TMS or do not leverage an ERP, direct access via Fides’ ARS Web Portal is available.

- Hybrid Delivery Model

- Clients may also leverage a hybrid delivery model whereby centralized treasury teams integrate ARS into their infrastructure while also allowing remote treasury subsidiaries to access the capabilities directly through the ARS Web Portal.

Regardless of geographic location or internal technology infrastructure, the Fides ARS solution ensures that all clients can gain complete visibility into global transaction data economically, efficiently, and securely – all at the touch of a button.

Flexible data access

Global subsidiaries that are not using the client’s treasury technology or ERP can gain visibility into global transaction data by streamlining all transaction data and reports through ARS. Smaller, multinational companies can also use Fides services to consolidate all transaction and replace spreadsheets without investing in expensive technology.